chapter 13 bankruptcy Options

, individuals in Virginia can pave the way toward a personal debt-totally free foreseeable future and start rebuilding their economical balance by using a clean slate.

“Absolutely everyone demands stuff to help keep a occupation plus a home,” suggests Auburn, Calif.-dependent attorney and buyer finance advisor Lyle Solomon, “and bankruptcy's refreshing commence will be meaningless if it deprived you of every little thing you have.

The first step in the Chapter seven bankruptcy approach is recognized as pre-filing. That is once you meet which has a Virginia bankruptcy attorney, like myself, to discuss your financial condition and figure out if Chapter 7 is the best option for yourself.

Credit score.org is often a non-profit provider which has a forty five-calendar year additionally historical past of excellence and integrity. What's even better, their financial coaching for bankruptcy possibilities is accessible at Definitely no demand. It's important to understand how Credit.

We appreciate the thorough info offered on Every lending husband or wife, with 1000s of shopper assessments to help you select which one is your best option for a personal personal loan. LendingTree has an incredible track record which is a honest choice if you want to make use of a referral services to investigation and safe a financial loan.

Getting everything from Chapter 7 applicants would do very little to acquire them back on their own toes, ready to become economically prosperous contributors for their communities.

On the other hand, some debts, like student loans and taxes, will continue to be. There are actually strict prerequisites for who qualifies for this type of bankruptcy. And it will stay with your report for a decade, which may affect your capacity to get a house, have next page a auto, or perhaps receive a task.

By filing for Chapter 13 bankruptcy, they ended up capable to stop the foreclosure and continue to be inside their property. With their now-steady revenue, they can easily click for more pay their house loan each month while also spreading the $25,000 back payment above a 5-12 months interval.

That is determined by the provider, but Certainly: most credit card debt consolidation systems provide you with a personal loan to pay back all your superb debts. These loans commonly have Significantly reduce curiosity fees and will let you image source get along with your economic problem once more.

Definitely. A large number of persons use personal debt consolidation applications each and every year to tackle their toughest credit rating issues. It's a good idea to check out the status of any method you're considering: learn what other consumers say regarding their ordeals, see In the event the BBB has rated the business, and figure out for yourself if their financial debt consolidation companies are worth your time and effort and (perhaps) income.

Credit score.org is usually a non-revenue company having a 45-calendar year furthermore historical past of excellence and integrity. In addition, their financial coaching for bankruptcy choices is out there at Completely no cost. It's essential to know how Credit history.

If you're looking at Look At This filing for bankruptcy, you're not by yourself. Each year, numerous hundreds of people file for bankruptcy on account of their overpowering personal debt.

Even though you could be in a position to open up new strains of credit score once a single to 3 several years after filing for bankruptcy, your fascination fees will be Significantly higher. Demonstrating capability to fork out These debts in time is the only real method of getting the curiosity premiums down.

And - whether or not most of your respective credit card debt is erased by way of a bankruptcy filing, you'll typically nevertheless owe one hundred% of go to website your scholar financial loan financial debt and taxes.

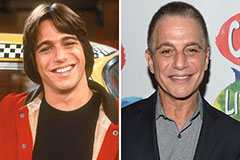

Tony Danza Then & Now!

Tony Danza Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Jeri Ryan Then & Now!

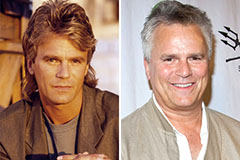

Jeri Ryan Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!